Transparency is important to us.

That is why we joined the German Chapter of Transparency International (Initiative Transparente Zivilgesellschaft).

We agree to make the following information available to the public and keep them up to date at all times.

Name, registered office and year of foundation

Röchling Stiftung GmbH

Richard-Wagner-Str. 9

68165 Mannheim

Tel: +49 621 – 44 02 – 232

Fax: +49 621 – 44 02 – 111

E-Mail: info@roechling-stiftung.de

Traditionally committed to social commitment, the Röchling family of entrepreneurs founded the Röchling Stiftung GmbH in 1990 as an equal shareholder of the family business. The proceeds from this industrial participation, increased by contributions from the family circle, feed the foundation’s assets and enable it to continue its work.

Articles of Association

Articles of Association of the Röchling Stiftung GmbH date, May 29th 2018

(1) The name of the company is: Röchling Stiftung GmbH

(2) The registered office of the Foundation is in Mannheim.

(3) The Company will be referred to as “Foundation” in the following.

[/iee_expanding_sections][iee_expanding_sections title=”§ 2 Objects” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) The Object of the Foundation is the acquisition and holding of shareholdings and other assets, in particular, equity interests in Röchling SE & Co. KG, and the use of the earnings therefrom as well as other donations for non-profit, charitable and religious purposes.

(2) The Foundation exclusively and directly pursues non-profit, charitable and religious purposes within the meaning of section 51 et seq. “Tax-privileged objectives” of the German Tax Code [Abgabeordnung, AO]. It is a charitable organisation and does not primarily pursue its own economic goals.

(3) The Foundation is obliged to use any return on its assets in particular for

a) scientific works, in particular the generation, detailed study and development of scientific findings in the fields of technology (e.g. new materials, new manufacturing systems), economics (e.g. innovation management) and social sciences, and primarily through

– the promotion of research projects in these fields at universities, technical colleges and non-university establishments,

– the awarding of overseas scholarships to young scientists within this field,

– the promotion of relevant scientific conferences,

b) education and vocational training,

c) the promotion of international sentiment and tolerance in all cultural aspects and a spirit of international understanding;

d) environmental protection, to the extent that keeping the air and water clean, fighting noise pollution, waste disposal and improving the safety of nuclear plants are sponsored;

e) the support of individuals who are reliant on the assistance of others due to their physical, mental or emotional condition or are in need within the meaning of section 53.2 of the German Tax Code;

f) the awarding of prizes for outstanding achievements in the areas listed under letters a) – e), insofar as the awarding of such a prize is mandated by the donor in question. The prize shall bear the name mandated by the donor in question. Should the donor neglect to specify a name, said name shall be determined by way of a resolution at the Shareholders’ Meeting;

g) the sponsoring of research projects and relevant conferences in the areas mentioned under d) – e);

h) the sponsoring of the preservation of historic monuments, whereby the sponsoring of the preservation of historic monuments refers to the conservation and restoration of recognised buildings of historic importance as defined in the respective national legislation;

i) the sponsoring of religious communities within the meaning of section 54 paragraph 1 of the German Tax Code.

(4) Purpose of the foundation is also the procurement of funds in accordance with § 58 No. 1 AO for the promotion of the aforementioned tax-privileged purposes for the realisation of the tax-privileged purposes of another corporation or for the realisation of tax-privileged purposes by a corporation under public law, or, insofar as it does not act in the way of institutional promotion, by carrying out its tasks itself or through an auxiliary person within the meaning of § 57 Paragraph 1 Sentence 2 AO. Within this framework, the Foundation may also promote purposes abroad.

(5) The Foundation shall be entitled and obligated to reject donations that are incompatible with the Foundation’s object.

[/iee_expanding_sections][iee_expanding_sections title=”§ 3 Share Capital” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””]The Company has a share capital totalling 52,200.00 euros.

[/iee_expanding_sections][iee_expanding_sections title=”§ 4 Shareholders, Shareholdings” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) The founding shareholders were allocated the funds for the acquisition of their capital investment by the Röchling SE & Co. KG with the proviso that said funds be used for the purpose of establishing the Foundation and serve the Object of the Foundation in perpetuity. Thus, the founding shareholders and their successors (Shareholders) hold their shareholdings in the Foundation not for their own profit, but as trustees for the purpose of fulfilling the Object of the Foundation. This special obligation of the Shareholders must always be borne in mind when interpreting the Articles of Association and exercising and performing shareholder rights and duties.

(2) The successors of the Shareholders shall in each case be appointed by the Röchling SE & Co. KG Shareholder Committee.

(3) A successor for a Shareholder shall be appointed,

- a) if the Shareholder communicates to the Foundation by registered post that he wishes to

leave the shareholder pool,

- b) when the Shareholder has reached his/her 75th birthday,

- c) when the Shareholder dies,

- d) if the remaining Shareholders decide with a 75% majority of the votes cast at an Extraordinary General Meeting convened expressly for this purpose that there is an important reason for the Shareholder to be disqualified (grounds for exclusion). Grounds for exclusion include, but are not limited to,

- aa) if a Shareholder is guilty of committing a serious breach of the duties incumbent on him/her in his/her capacity as Shareholder,

- bb) if the behaviour or an intrinsic trait of a Shareholder makes it unreasonable, impossible or considerably more difficult to work with him/her in fulfilling the Foundation’s Object,

- cc) if a Shareholder is heavily indebted or insolvent, if he/she no longer has full legal capacity or if a custodian or legal guardian has been appointed to manage his/her financial affairs,

- e) if the Röchling SE & Co. KG Shareholder Committee communicates by registered post that it has decided to replace or remove a Shareholder.

(4) The successor shall be appointed within a period of three months. This period begins

- a) in the case of clause (3) a) on the date that the letter from the Shareholder is received by the Foundation,

- b) in the case of clause (3) b) on the last day of the Shareholder’s 75th year of life,

- c) in the case clause (3) c) immediately the Company becomes aware of the death of said Shareholder,

- d) in the case of clause (3) d) once the remaining Shareholders resolve that grounds for exclusion exist,

- e) in the case of clause (3) e) on the date that the letter from the Röchling SE & Co. KG Shareholder Committee is received by the Foundation,

(5) The shareholder rights ensuing from a shareholding are held in abeyance until transferred to a Successor appointed in accordance with the provisions in this Agreement

- a) in the case of the death of a Shareholder, from the time of death,

- b) in the case of clause (3) d) from the time of the shareholder resolution that determines grounds for exclusion exist,

- c) in the case of clause (3) e) from the date that the letter from the Röchling SE & Co. KG Shareholder Committee is received by the Foundation,

(6) The departing Shareholder or his/her heirs must transfer his/her shareholding to the Successor without charge within one month of the Foundation informing the departing Shareholder of the Successor’s name. Should this not occur within the stipulated deadline, the Shareholders can, with a majority of 75% of the votes of the Shareholders excluding the Shareholder concerned, resolve that the shareholding of the Shareholder concerned be transferred to the Foundation or to a person prepared to accept it as named in a resolution without charge. Said resolution must be notarised.

(7) Moreover, a resolution aimed at effecting the transfer of said shareholding without charge pursuant to paragraph (6), clauses 2 and 3 is still valid even when this shareholding is subject to a seizure order.

(8) A transfer of shareholdings in circumstances other than those indicated in this paragraph, as well as any other act of disposal of the shareholdings (e.g. pledging as security), is ineffective.

[/iee_expanding_sections][iee_expanding_sections title=”§ 5 Participation and Right to Vote at Shareholders’ Meetings of the Röchling Family Companies” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””]The Company can only be represented in the Röchling SE & Co. KG Shareholders’ Meeting by one member of the Röchling SE & Co. KG Shareholders’ Committee.

The Company has no right to vote in the meetings of the above-mentioned companies.

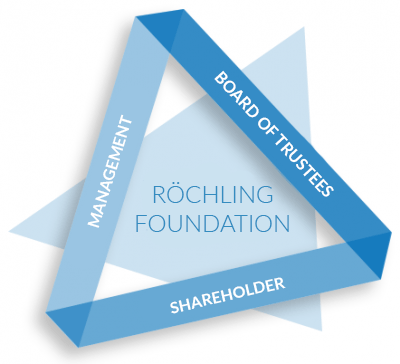

[/iee_expanding_sections][iee_expanding_sections title=”§ 6 Organs” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) The Organs of the Foundation are:

a) the Shareholders’ Meeting

b) the Board of Trustees

c) the Managing Director(s).

(2) The Shareholders’ Meeting sets the annual financial framework for the Foundation’s work. The job of the Board of Trustees is to plan and approve individual Foundation projects within this framework whilst taking into account the wishes of the benefactors and donors.

(3) The Shareholders’ Meeting can draw up rules of procedure that define the function of the organs in detail and that describe the actions and activities for which the Executive Board requires the authorisation of the Board of Trustees to undertake.

[/iee_expanding_sections][iee_expanding_sections title=”§ 7 Shareholders’ Meeting” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) The Annual General Meeting, which resolves to adopt the annual statement of accounts and to discharge the Managing Directors, shall be held at the latest within six months of the end of the financial year. In addition to this, Shareholders’ Meetings shall be held when a Shareholder, the Chair of the Board of Trustees or a Managing Director requests this.

(2) The Shareholders’ Meeting shall be convened by the Managing Directors by letter, telegram or telex and include a copy of the agenda at least 14 days before the scheduled date of the meeting.

(3) Every Shareholder has a vote at the Shareholders’ Meeting. Absent members can have attending members cast their written vote. Proxy representation is not permitted.

(4) The Shareholders shall select a chairperson to serve for a period of four years to chair the Shareholders’ Meeting. Should this be hindered for some reason, the oldest Shareholder shall chair the meeting.

(5) The Shareholders’ Meeting constitutes a quorum if at least half of the Shareholders are present or taking part by way of written voting. Resolutions are adopted by a simple majority of votes, insofar as a larger majority is not otherwise stipulated by law or in this Agreement.

(6) Provided that all Shareholders are in agreement about the form of resolution adoption and provided there are no mandatory form requirements, the resolutions of the Company may be adopted by other methods, primarily outside of Shareholders’ Meetings, in particular through postal circulation in written form, orally or by telephone, fax or email;in combined proceedings, in particular, through the combination of a meeting of individual Shareholders with a – prior, simultaneous or subsequent – vote of the other Shareholders within the meaning of a) (e.g. partly in written form, partly by email etc.).

(7) Minutes shall be kept for evidentiary purposes of every Shareholders’ Meeting and of every resolution adopted by the Shareholders in accordance with paragraph 6. If no notarially attested act is performed, the secretary shall be appointed by the Chairperson. A copy shall be forwarded to every Shareholder. The contents of the minutes shall be considered approved by the Shareholder if he does not challenge their fidelity in writing within two weeks of receipt specifying his/her reasons.

(8) The Shareholders are entitled to have their out-of-pocket expenses reimbursed, in particular, their travel expenses.

[/iee_expanding_sections][iee_expanding_sections title=”§ 8 Board of Trustees” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) The Board of Trustees shall consist of between two and seven people. Shareholders cannot be elected to the Board of Trustees.

(2) The members of the Board of Trustees shall be elected by a simple majority at the Shareholders’ Meeting to serve for a period of four years. Re-election is permissible.

(3) The Board of Trustees shall elect one of its members to serve as Chairperson of the Board of Trustees for the duration of one term of office.

(4) The members of the Board of Trustees are entitled to have their out-of-pocket expenses reimbursed, in particular their travel expenses.

(5) The Board of Trustees has a quorum when at least half of its members are present. Resolutions require a simple majority of the cast votes.

(6) Provided that all members of the Board of Trustees are in agreement about the form of resolution adoption and provided that there are no mandatory form requirements, the resolutions of the Board of Trustees may be adopted by other methods, primarily outside of Board of Trustee meetings, in particular through postal circulation in written form, orally or by telephone, fax or email; in combined proceedings, in particular, through the combination of a meeting of individual Board of Trustees members with a – prior, simultaneous or subsequent – vote of the other Board of Trustees members within the meaning of a) (e.g. partly in written form, partly by email etc.

(7) Minutes shall be kept for evidentiary purposes of every Board of Trustees meeting and of every resolution adopted by the Board of Trustees in accordance with paragraph 6. The secretary shall be appointed by the Chairperson of the Board of Trustees. A copy shall be forwarded to every member of the Board of Trustees. The contents of the minutes shall be considered approved by the member of the Board of Trustees if he/she does not challenge their fidelity in writing within two weeks of receipt specifying his/her reasons.

[/iee_expanding_sections][iee_expanding_sections title=”§ 9 Executive Board, Representation” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) The Foundation shall have one or more managing directors. The first managing director shall be appointed or recalled by the Shareholders’ Meeting. Additional managing directors shall be appointed or recalled by the Shareholders’ Meeting in consultation with the Board of Trustees.

(2) If only one managing director is appointed, he shall represent the Foundation alone. If several managing directors are appointed, the Foundation shall be represented jointly by two managing directors or by one managing director together with an authorised signatory. The Shareholders’ Meeting can grant one or more managing directors sole powers of representation and exemption from the restrictions set out in § 181 BGB.

(3) A managing director of the Röchling Stiftung GmbH may not concurrently be a managing director of Röchling SE & Co. KG.

[/iee_expanding_sections][iee_expanding_sections title=”§ 10 Financial Year, Financial Statement and Use of Revenue” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) The financial year of the Foundation shall be the calendar year. The first financial year shall begin with the registration of the Foundation and end on the 31st of December in the year of registration.

(2) Each year, at the end of the financial year, the financial statement shall be prepared by the Executive Board within the statutory deadlines.

(3) The annual earnings available according to the financial statement may only be used for the Foundation’s object. A reserve fund may be established for the purpose of fulfilling the long-term work of the Foundation. The Shareholders shall not receive any dividends nor any other remuneration from Company funds in their capacity as Shareholders.

(4) No person may benefit from administrative expenditures that do not pertain to the objects of the Foundation or receive unreasonably high compensation.

[/iee_expanding_sections][iee_expanding_sections title=”§ 11 Dissolution of the Foundation” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) A Shareholder resolution that resolves to dissolve the Foundation shall require a majority of 75% of the votes of all Shareholders.

(2) The liquidators shall be the managing directors, unless the Shareholders delegate liquidation by simple majority vote to other persons.

(3) The proceeds from the liquidation are to be used for charitable purposes within the Federal Republic of Germany.

The resolutions regarding the use of liquidation proceeds may only be enacted with the consent of the responsible tax authority.

[/iee_expanding_sections][iee_expanding_sections title=”§ 12 Amendments to the Articles of Association” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””](1) Amendments to these Articles of Association shall require a majority of 75% of the votes of all Shareholders.

(2) Amendments that affect the right of the Röchling SE & Co. KG Shareholder Committee to appoint and recall Shareholders shall require the agreement of the Röchling SE & Co. KG Shareholder Committee.

[/iee_expanding_sections][iee_expanding_sections title=”§ 13 Public Announcements” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””]Public announcements shall be published in the electronic Bundesanzeiger (German Federal Gazette).

[/iee_expanding_sections][iee_expanding_sections title=”§ 14 Severability Clause” description=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” element_typography=”custom” typography_title=”Open Sans:regular” title_font_size=”28″ typography_description=”Open Sans:300″ description_font_size=”18″ heading_color=”” background_color_1=”” background_color_2=”” gradient_direction=”0deg” background_color_content=””]Should any provision in this Agreement be or become invalid or ineffective in whole or in part, or should this contract contain a gap or loophole, this shall not affect the validity of the remaining provisions. The invalid or ineffective provision shall be replaced with a valid provision that most closely reflects to the intent and purpose of the invalid or ineffective provision. In the case of a gap or loophole, a provision shall be agreed that reflects the intent and purpose of this Agreement and would have been agreed if the issue had been known about from the outset.

[/iee_expanding_sections]Name and function of key stakeholders

All persons mentioned do not receive any payment other than reimbursement of expenses.

Date of most recent tax office exemption

Tax office

Mannheim

Tax identification number

38146/12622

Last date of issue

18.02.2021

Latest assessment period

2017-2019

Activity report

A responsible and environmentally friendly handling of plastic is one of the most pressing global challenges of our time. The Röchling Foundation is committed to ensure that technological progress serves the preservation of natural resources rather than endangering them.

The Röchling Foundation acts as a supportive, as well as an operational foundation. It supports research projects and civil society initiatives that contribute to solving the global challenge of plastic and the environment. With its own activities, the Röchling Foundation connects researchers, activists and entrepreneurs with each other in order to promote their cooperation.

Staff Structure

Job shares of all involved 125 k€

1 honorary managing director, 6 honorary board members, 3 honorary shareholders, 1 foundation manager (part-time 80%), 1 foundation consultant (part-time 50% until 10/2020; part-time 60% from 11/2020).

Source and application of funds

Revenue and Source of Funds

Donations received

0 €

Profits from asset management

629 k€

Profit on ordinary activities

968 k€

Government grants

none

Income from services

none

Expenditure

Expenses for statutory funding

490 k€

Administrative expenses

39 k€

In 2019, the funding was split between the various projects as follows:

“Biological solution for global challenges: Polymers bio-degradation by biological systems”

CSIC – Consejo Superior de Investigaciones Cientificas, Dr. Frederica Bertocchini

150 k€

Ökologische Bewertung von Stetigförderern mit Kunststoffketten und Ausweis Umweltbilanz, TU Chemnitz

52 k€

“Maritime Müllabfuhr / See-Elefant”; One Earth One Ocean e.V.

50 k€

Combating Plastic Pollution in the Sundarbans, SOCEO II

55 k€

„Act on Plastic Challenge – Soulincubator”; Project Together

216 k€

“ValueCred”; Yunus Environment Hub

100 k€

Corona-Sonderbudget

60 k€

Röchling Kapelle

12 k€

Corporate Solidarity

The Röchling Foundation holds all shares of the Röchling Stiftungszentrum GmbH (i.L.), Mannheim

Names of legal persons

The Röchling Foundation is financed by capital revenue and donations from the Röchling family.

There are no individual donations, more than 10% of the total annual income.